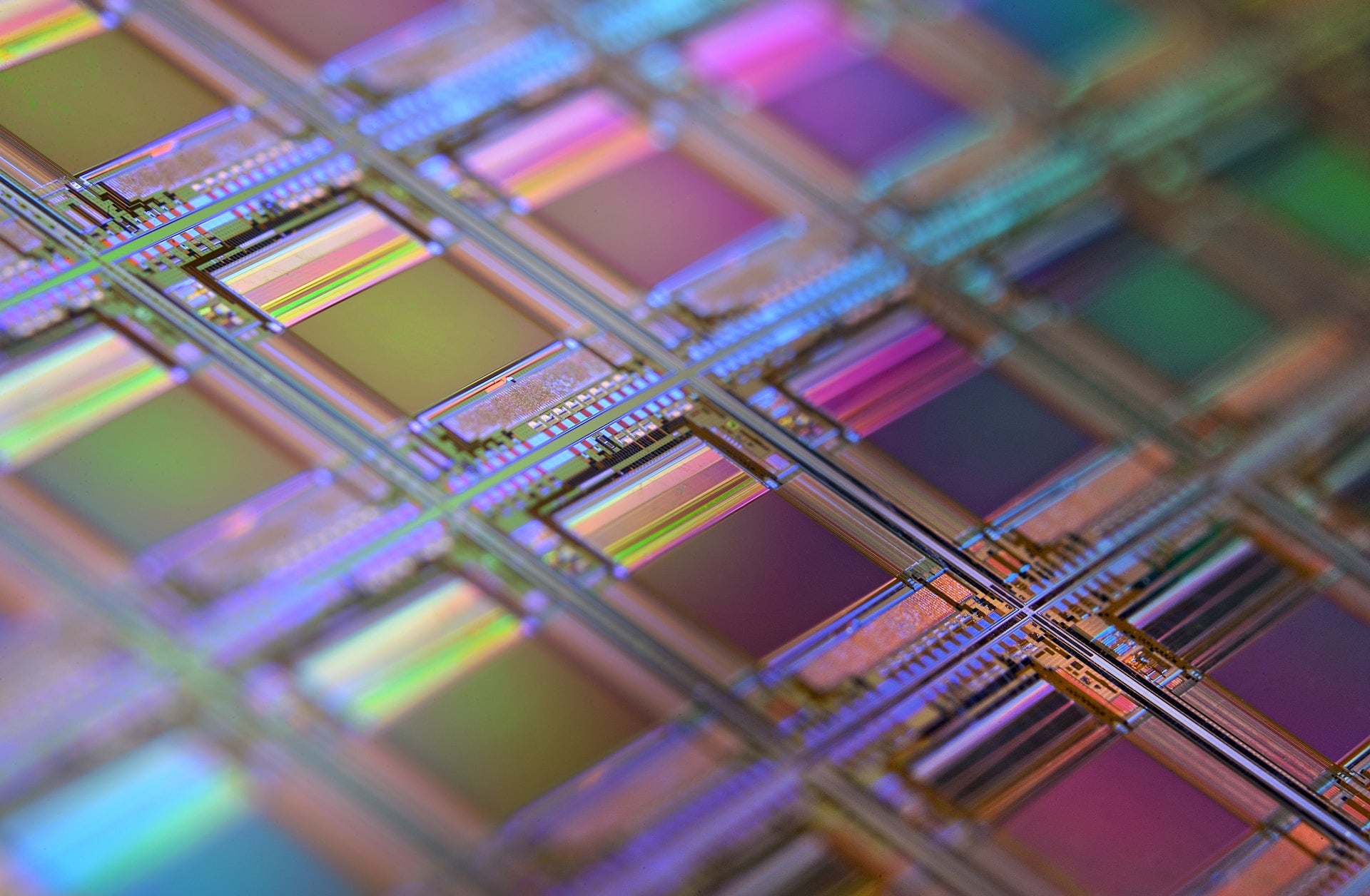

The Government of Japan has released a new strategy with semiconductors at the core of the economic security policy, reported Bloomberg.

By 2030, Japan aims to triple the sales of domestically produced chips to over Y15tn ($108bn), the publication said, citing the country’s economy ministry.

The updated plan aims to intensify efforts to create advanced semiconductors that are essential for technological advancements such as generative artificial intelligence (AI) as well as economic security measures.

According to the strategy, the sales objective for Japanese chip manufacturing companies will aid in ensuring a consistent supply of semiconductors for the country.

In 2020, the chip sales target was around Y5tn ($35.8bn).

Speaking to reporters before the release of the strategy, Japanese Economy Minister Yasutoshi Nishimura said: “Various investments are being made by Japanese chip-related companies including smaller ones, and we would like to back up these investments.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“We want to secure the necessary budget to support these efforts.”

The plan did not provide information about how much money the government intends to spend in the upcoming years.

Billions have already been allocated to Taiwan Semiconductor Manufacturing Company (TSMC) to support it to increase production capacity and to finance Japan’s own chip venture Rapidus.

For Rapidus, the government has committed Y330bn ($2.36bn) in funding, and it could contribute up to Y476bn ($3.4bn) to TSMC’s new factory in Kumamoto, southern Japan.

Additionally, the government is financing computer memory manufacturer Kioxia’s facility in Mie, central Japan, with subsidies of up to Y92.9bn ($665.5m). To remain competitive with the rest of the world, Japan will examine tax incentives and subsidies for businesses investing in semiconductors, storage batteries, biomanufacturing, and data centres, the publication said, citing the country’s revised economic plan