Buy-now-pay-later (BNPL) $45.6bn behemoth Klarna is reportedly continuing its shopping spree by buying loyalty card startup Stocard for €110m. Klarna scooping up another fintech is seen as more proof that the Swedish quadradecacorn is expanding into new avenues in response to the BNPL market growing increasingly crowded.

Neither Klarna nor Stocard have officially confirmed the deal. However, given Klarna’s CEO and founder Sebastian Siemiatkowski on Sunday retweeted a link to EU-Startups, which was first to break the story, we can confidentially say the deal is going through, even though the final details may differ slightly.

Klarna declined Verdict’s request for comment on the Stocard acquisition.

The Stockholm-based BNPL company has been on a shopping spree of late. The Stocard deal would mark Klarna’s second acquisition in July alone, having bought HERO, a social shopping platform, for $160m earlier in the month. Klarna has previously bought Moneymour, Nuji and ShopCo Technologies, as highlighted in GlobalData’s Intelligence Centre’s company profile.

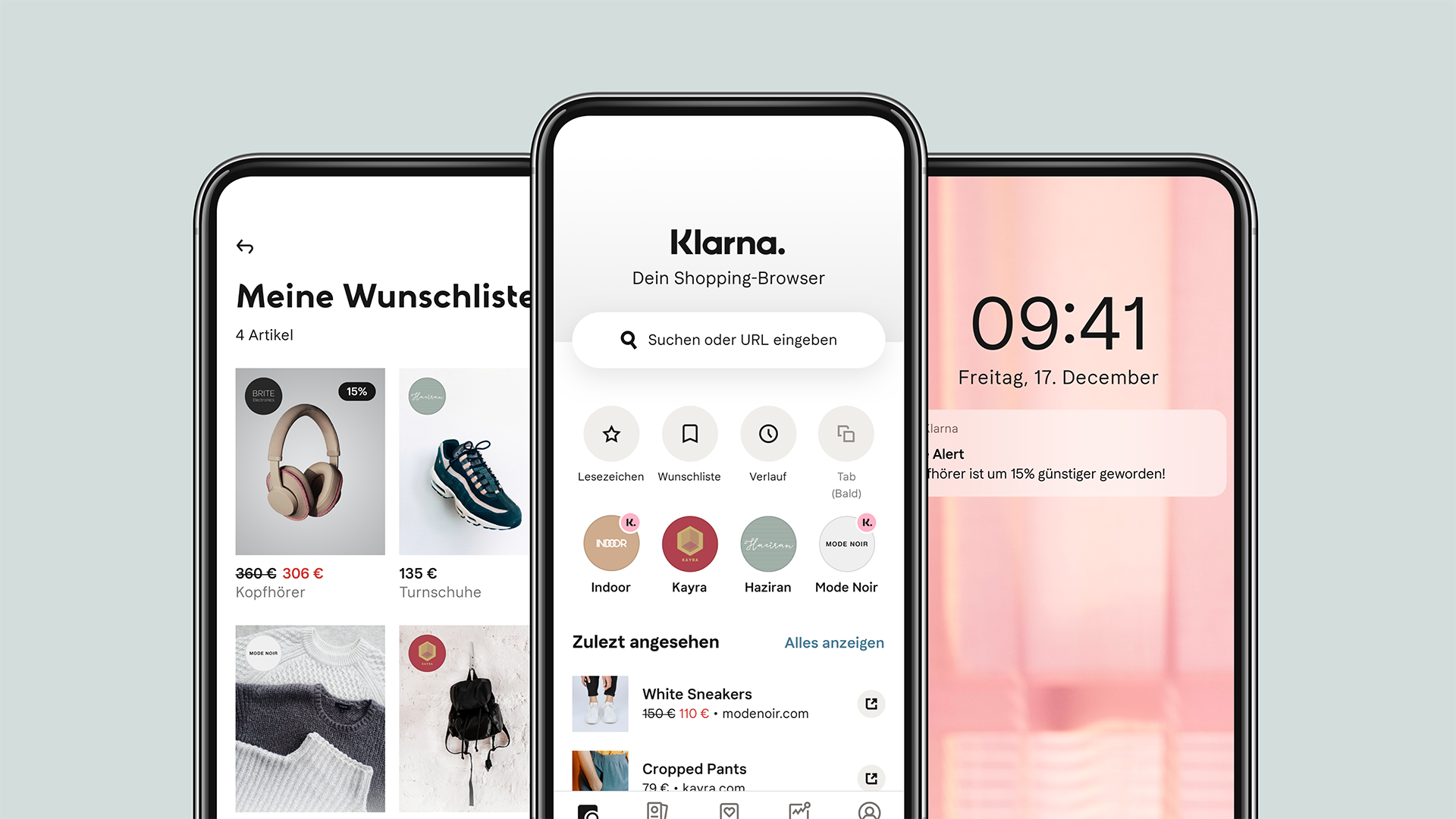

By buying Stocard, Klarna will be able to add the Mannheim-based fintech’s offering to its own. Stocard provides a mobile wallet to its 60 million customers, which enables users to bundle customer loyalty cards in the Stocard app, with discounts also included.

Not only are these solutions attractive in their own right, but the acquisition could arguably enable Klarna to push its own card on Stocard’s 60 million customers.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataKlarna’s Stocard deal also seemingly fits into the ecommerce company’s overarching strategy of becoming more than a BNPL provider. Over the years, it has pushed into open banking, opened German bank accounts and a price comparison site. The site enables Klarna to tap into some of the ad revenue that Google would’ve traditionally scooped up.

“The fast growth of the BNPL sector has meant that Klarna is moving to diversify its offering and aim to target a broader customer base quickly,” Jaimini Pattani, analyst at GlobalData, tells Verdict.

“Additionally, the industry will be regulated soon, creating additional costs for Klarna. Therefore, to continue growing, it’ll need to move in other directions, such as partnerships and acquisitions.”

Crowded market

The quadradecacorn expanding its services comes as the BNPL market is growing increasingly crowded. Not only is Klarna facing competition from traditional BNPL businesses like Afterpay, Affirm and Zilch, but also from big corporates who have traditionally stayed clear of instalments.

For instance, PayPal has recently entered the space. Apple is also rumoured to be adding BNPL services to its fintech solution soon.

It’s easy to see why there’s growing interest in the sector: GlobalData Thematic Research estimates that the market will be worth $166bn by 2023. Tapping into it therefore makes sense for bigger players.

However, the increasingly crowded space has also forced companies like Klarna to adjust.

“Overall, the sector is booming and moving fast, with many different BNPL propositions in the market suiting the needs of varying consumer lifestyles, such as the recent focus on travel instalment options,” Pattani says. “With new entrants entering markets across the globe fast and competition heating up, it’s likely this is only the start of what we are seeing for players like Klarna.”

Indeed, Klarna’s Australian rival Afterpay unveiled its upcoming money management app last week in collaboration with disgraced Australian bank Wespac. The bank was fined AUS$1.3bn ($951m) in 2020 for breaching anti-money laundering rules a total of 23 million times in the last decade.

The news comes after Klarna secured a $45.6bn valuation on the back of a $639m SoftBank-led investment round in June. The deal arguably made Klarna Europe’s most valuable privately-owned tech company.

Klarna had already claimed the title of Europe’s most valuable privately-owned fintech company after it achieved a $31bn valuation in March on the back of a $1bn funding round

“The popularity of Klarna has soared, and the firm is considered one of Europe’s highest valued private fintech as more consumers are drawn towards the appeal of this interest-free, cost spreading, and convenient payment option,” says Pattani. “This has been true especially among the younger cohort, such as generation Z and millennials.”