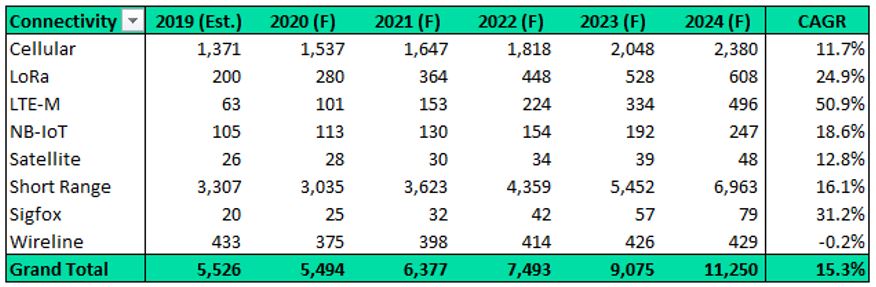

According to new forecasts from GlobalData, the global number of Enterprise-related Internet of Things (IoT) connections will reach 11.2 billion by 2024, dominated by short-range and cellular connections, but with strong growth (starting from a much smaller base) for Low Power Wide Area Networks (LPWANs).

The Compound Annual Growth Rate (CAGR) for the six-year period for all IoT connectivity types is moderate, at 15%. The 2020 forecast was tamped down slightly to account for the effect of Covid-19 on technology spending; however, from 2021 onwards, growth is expected to continue at a higher rate.

In addition, many operators note that new offerings that help with Covid-19 detection and mitigation, such as room/building occupancy monitoring and management, and remote thermal temperature scanning, have actually had a positive effect on new deployments.

These numbers are only moderately good news for mobile operators which will see their cellular connections grow by a CAGR of only 12% over five years, while their licensed spectrum LPWANS (including NB-IoT and LTE-M) will grow more significantly by 19% and 51% respectively but which start from a much lower installed base.

Short-range access types (which include Wi-Fi, Bluetooth, RFID, Z-Wave, and Zigbee) will dominate the number of connections throughout the period. However, while operators may source, resell, or help deploy short-range access and solutions, these technologies do not appreciably boost their connectivity revenues in IoT, which come primarily from cellular and LPWAN connectivity.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataMonetization problems in beyond-connectivity IoT services

Operators have been trying to make money in beyond-connectivity IoT services for many years with mixed success. Most tier 1 service providers have added consulting and advisory services, proof of concept, deployment/pro services/integration, and ongoing managed services such as connectivity and device lifecycle management, as well as third party applications and application enablement.

While this makes sense when courting large corporate customers and MNCs, these value-added services may not make sense for SMBs or for the types of use cases that dominate LPWANs; these are optimized for low bandwidth, low-touch, long-term deployments with low or sporadic data transmission requirements.

For that reason LPWANS typically cost less for the customer than traditional cellular options, but their value to the operator rests largely on the expectation of “massive connectivity” rather than on providing the operators with more lucrative value-added services.

5G may bring a boost

The advent of 5G may eventually have a positive effect on LPWAN growth, as the capacity and density expected for these new networks in a few years includes explicit support for “massive IoT”. On the high end, 5G (combined with edge computing) is expected to drive the next generation of IoT use cases that require very high speed and very low latency such as robotics, drones, autonomous vehicles, AR/VR for training and maintenance, and real-time data and video collection and analytics.

In the meantime, the operators often remain marginalized by other members of the IoT ecosystem that may be better positioned to provide business consulting, private networks, end-to-end security solutions, custom application development, and data analytics.

Network and carrier infrastructure equipment vendors, Wi-Fi vendors, IT service providers, systems integrators, cloud hyperscalers, IoT platform vendors, and even automotive OEMs are infringing on segments and services in which mobile operators participate. While GlobalData forecasts predict a market of over $786 billion in global enterprise IoT revenues by 2024, connectivity is only about $46 billion, or 6% of the total, with most of the revenues going to devices, services, and solutions.

Beyond network revenue is vital

Operators can and do partner with all of the ecosystem players mentioned above. But they need to make sure that they get a cut of revenues beyond their networks. While they need third party equipment, platforms, applications, and cloud resources, they may falter in getting a reasonable revenue share from their partners as they try to offer or be a part of end to end solutions.

And while they may take the lead for some IoT projects due to their connectivity and their relationships with existing enterprise customers, they often lack the ability to be the prime integrator, especially for large complex lucrative global engagements.