Banking, insurance and other financial services organisations have shown they are eager to apply AI solutions such as chatbots, deep learning and machine learning.

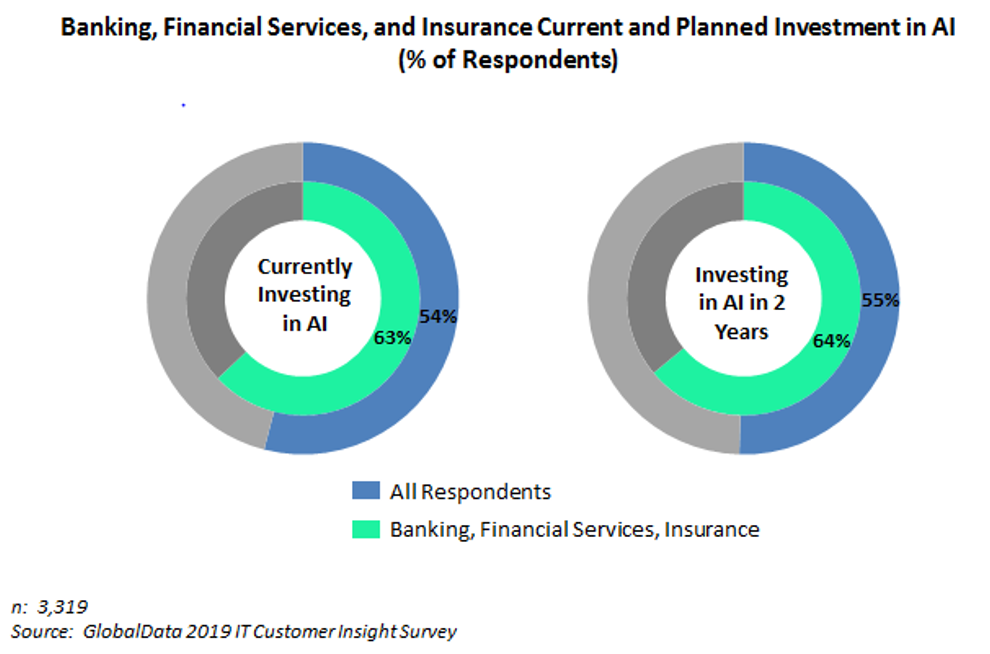

According to GlobalData’s most recent IT Customer Insight survey, companies in this sector are more likely to prioritise investment in AI technology than their counterparts across other vertical industries.

As shown below, 63% of respondents in banking, financial services and insurance currently prioritise investments in AI, compared to only 54% of companies across other markets. Similarly, 64% of financial services, insurance, and banking organisations have prioritised AI for investment in the next two years, versus only 55% of total survey respondents.

Not only do these businesses have a wealth of data at their fingertips, offering a treasure trove of information that could yield valuable insights, but they also face numerous challenges, such as stringent regulatory requirements and ever-present security and fraud-related threats. As such, companies in this sector have much to gain from implementing AI.

The application of AI holds the promise of improving a range of horizontal functions, such as enhancing the customer experience and advancing industry-specific operations, such as transaction monitoring, fraud detection and data analysis.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataFor example, in terms of front-of-house operations, AI can assist with customer identification and providing a more tailored customer experience, while AI-driven chatbots can manage queries that come in from customers.

Behind the scenes, machine learning algorithms can help with fraud detection and prevention by identifying suspicious activity or unusual transaction. More specifically, banks are using AI to assist with anti-money laundering and know-your-customer (KYC) initiatives.

Successful AI implementation

Infosys helped a European bank implement AI to increase automation and reduce its dependence on manual processes, that resulted in human error, all the while improving security.

Wipro worked with an insurance company to help them better detect fraudulent claims and speed payments to authentic customers. And in another example, a banking customer used Wipro’s AI-driven HOLMES E-KYC solution to more quickly ensure regulatory compliance, hasten regulatory reporting and improve the customer experience.

But despite the documented benefit, adopting AI can prove to be a daunting task. The road is made easier when working with AI providers with a solid track record within their specific industry. Potential partners should be able to cite successful use cases and demonstrate a strong knowledge of local regulatory requirements. Also, businesses should explore the numerous pre-packaged solutions on the market that can often be tailored to specific needs. For example, KPMG’s AI platform, Ignite, includes intelligent forecasting, Libor analytics, qualified financial contract analysis, cognitive vouching and cognitive transfer pricing.

On the one hand, adopting AI requires a significant investment of time and resources; on the other hand, it’s an investment decision business cannot afford to avoid. It just needs to be done with planning and forethought.

Related Report:

Smart Money Investing in the Financial Services Industry – Q2 2019

Related Company Profiles

Wipro Ltd