Nicaragua’s total telecom and pay-TV revenue will increase at a compound annual growth rate (CAGR) of 3.5%, in local currency terms, between 2018 and 2023, according to a recent forecast by GlobalData.

Revenue will be mainly driven by the growing demand for mobile and fixed data services, as well as the increasing adoption of traditional pay-TV services, the analytics company said.

Nicaragua telecoms 2023

The mobile data segment, which accounted for 20.4% of the total telecoms revenue in 2018, will be the fastest growing segment, expanding at a CAGR of 14.1%, in local currency terms, over the period.

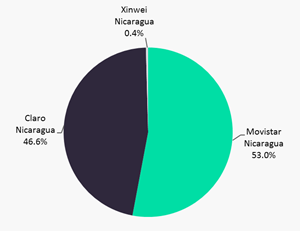

The central American country’s mobile communications sector is highly concentrated. The market is currently lead by Movistar Nicaragua and Claro Nicaragua, with a total combined market share of 99.6% as of year-end 2018; Chinese operator Xinwei, which entered the market in 2016 under the Cooltel brand, has yet to achieve expected growth and closed 2018 with only about 25,000 subscribers.

Total mobile subscription market share, 2018

Source: GlobalData

Despite having a leading position in the Nicaraguan mobile communications market, Movistar Nicaragua, controlled by Spanish operator Telefonica, was recently sold to Millicom, which also bought Telefonica’s operations in Panama and Costa Rica. Although the Nicaraguan deal, which was announced late February 2019, is still pending regulatory approval, we expect the operation will be greenlighted, heating up competition with Claro.