Mobile broker Pelican today announced its latest funding round as it continues to tempt cautious millennial investors into the stock market with its social trading app.

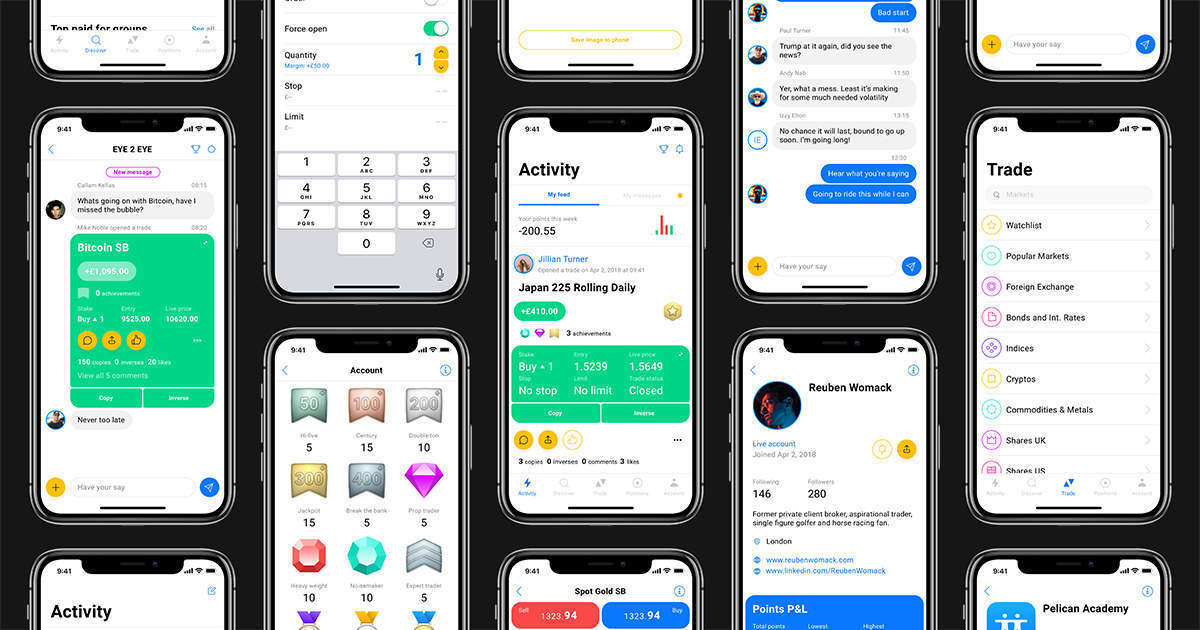

The app combines traditional mobile trading with customised social groups that allow traders to chat, share and compare live trades. The platform has also been designed to allow third-party brokers to plug into the Pelican app.

“Our app offers a new dynamic to solve the significant gap in trading profitability,” said Pelican founder Mike Read.

“By integrating communication into a central network for traders, we can offer a platform where live data and ideas can be shared between market professionals and retail traders on a fully-regulated platform.”

The FCA-regulated app offers access to over 10,000 global markets. According to the FCA’s latest analysis of CFD firms, 82% of clients lose money lose money when trading in isolation.

By contrast, those that trade in a community have been found to perform 40% more profitably than those using traditional digital brokers.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataA social trading app for the social network generation

When the collapse of the housing market sparked a global financial crisis in 2008, millennials were coming of age or early in their professional lives.

Between October 2007 and March 2009, the S&P 500 lost 57% of its value. Older millennials also remember the dot-com bubble of the early 2000s.

Unsurprisingly, this seems to have cultivated a distrust in the stock market among younger demographics.

A survey from Bankrate, for example, found that just 23% of those aged between 18 and 37 believe the stock market is the best place to put extra cash for the next ten years or more.

With age, that number increases – as high as 38% for baby boomers.

Another survey by Ally Financial finds that 66% of people aged 18 find the stock market intimidating or scary.

Yet while millennials grew up with a distrust for stocks, they grew up accustomed to social media: Facebook is most popular among 18 to 34-year-olds, according to Statistica data.

Pelican’s social network approach also taps into another millennial trait: ‘FOMO‘ – the fear of missing out. Social media gives people a non-stop stream of their friends activities; a social trading app will encourage those in the network to make similar investments when they see that they are paying off.

However, other factors, such as paying off student debt, rising house prices and wages still feeling the squeeze of the financial crisis ultimately mean that millennials have less cash to spare to invest.

Previous Pelican funding rounds in 2016 and 2017 raised £500,000 and £1m respectively. The startup has already been backed by senior IG executives and has the support of Venrex, which invested in app-based startups Just-Eat and Revolut and is currently valued at over £7m.

Read more: Millennial investors put greater faith in artificial intelligence