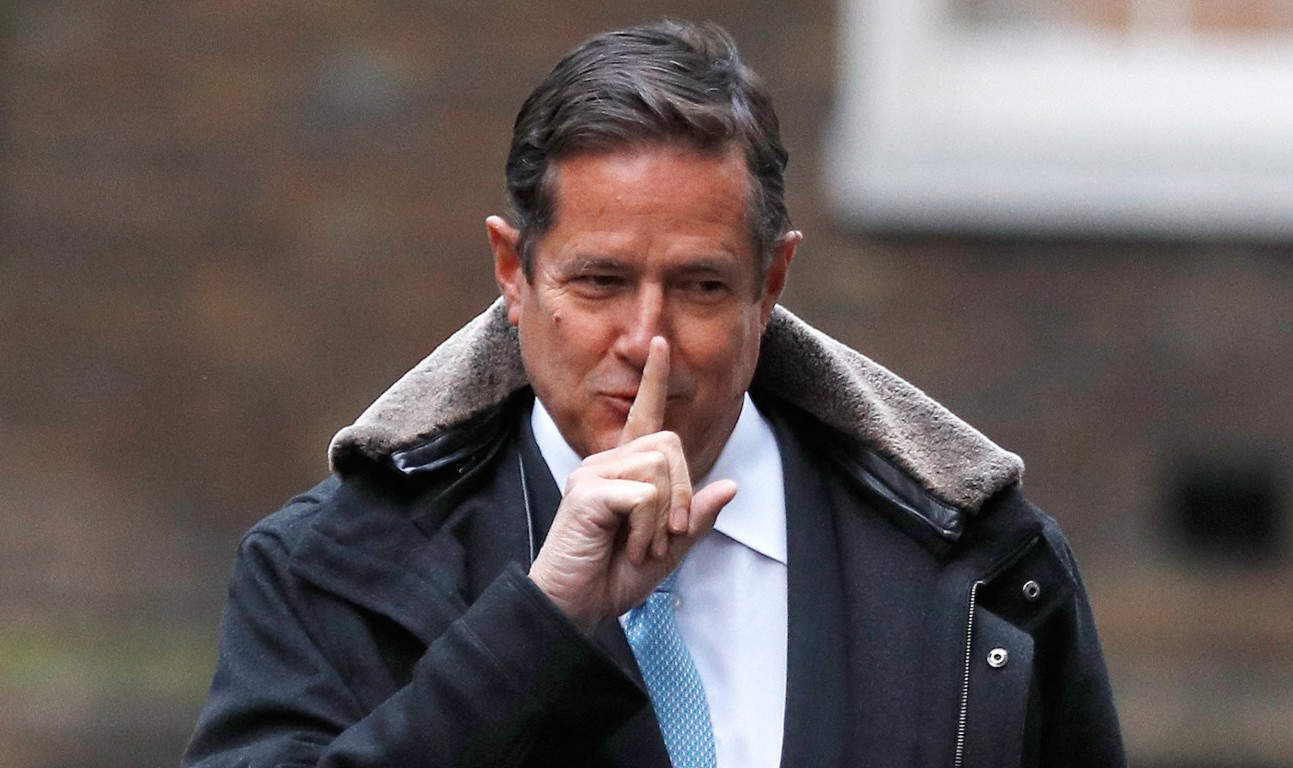

UK regulators have fined Barclays Bank chief executive Jes Staley an eye-watering £650,000 ($881,000) for attempting to unmask a whistleblower in 2016.

In a joint statement, the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA) said Staley made “serious errors of judgement” for attempting to find out who had made allegations to the bank about a recently recruited colleague.

The penalty amounts to 10% of Staley’s annual income.

As a result of a probe, the watchdogs said they were tightening controls on Barclays’ investigation processes to ensure it didn’t fall afoul of regulation again.

This marks the first time such measures have been taken against a bank in a whistleblowing scandal, they added.

The statement said:

Mr Staley failed to act with due skill, care and diligence in the way he acted in response to an anonymous letter received by Barclays in June 2016.

In light of Mr Staley’s actions above, the FCA and PRA have some concerns about the firm’s whistleblowing systems and controls, and have concluded that these require enhanced monitoring and scrutiny.

Barclays is, therefore, now subject to requirements by which it must report annually to the FCA and PRA, including any whistleblowing cases involving allegations made against its senior managers and any cases where Barclays has sought to identify any anonymous whistleblowers.

These measures, which apply to all cases until the end of 2020, are the first of their kind applied to a regulated firm in relation to whistleblowing.

Barclays accepted the penalties which will remain in place until 2020, the watchdogs said.

Mark Steward, FCA executive director of enforcement and market oversight, said:

Given the crucial role of the chief executive, the standard of due skill, care and diligence is more demanding than for other employees.

Mr Staley breached the standard of care required and expected of a chief executive in a way that risked undermining confidence in Barclays’ whistleblowing procedures.

Chief executives must act with a high degree of care and prudence at all times.

They added that whistleblowers play an essential part in financial services operations:

Whistleblowers play a vital role in exposing poor practice and misconduct in the financial services sector. It is critical that individuals are able to speak up anonymously and without fear of retaliation if they want to raise concerns.

Sam Woods, deputy governor for prudential regulation and chief executive of the PRA, said:

Protection for whistleblowers is an essential part of keeping the financial system safe and sound.

Mr Staley’s behaviour fell below the standard we require, resulting in today’s fine and public censure. In addition, Barclays is now subject to special requirements to report to the PRA and FCA how it handles its whistleblowing cases in the coming years.

It was found that Staley had used the bank’s internal security unit to try and identify the author of anonymous letters to Barclays that raised concerns about the recruitment of Tim Main.

Main, who was posted to head of the bank’s financial institutions group in New York, was a former colleague of Staley’s at JP Morgan.