When it comes to getting a reaction out of financial markets and traders it seems the Donald’s tweet is mightier than Kim Jong-un’s missiles, according to research from Goldman Sachs.

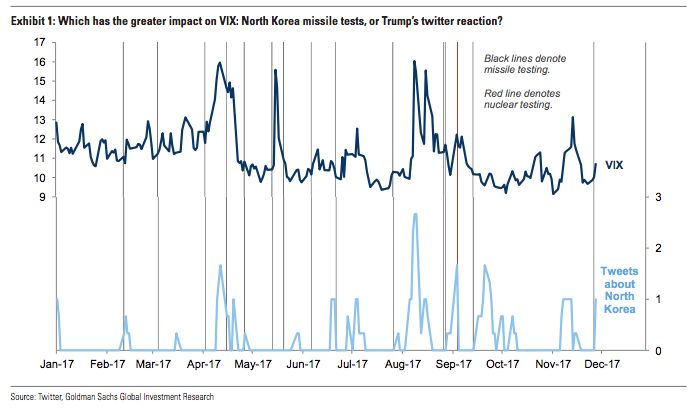

The research — entitled What matters more for the Vix: actual North Korea missile tests or Trump’s Twitter reaction? — measured how much the CBOE volatility index ( a measure of expected volatility in the US stock market over the next month and better known as the Vix) moved following reports of North Korea missile tests and US president Donald Trump’s tweets.

Goldman bankers wrote in a note to clients:

In a year during which the Vix otherwise had the pulse of a rock, North Korean missile launches appeared to be one of the few sources of volatility [and] we find evidence that it is the US reaction to North Korean testing – and president Trump’s Twitter account in particular – rather than the testing per se, that matters most for global risk appetite as reflected by the Vix.

To measure the impact of Trump’s tweets on the Vix Goldman counted the number of times Trump’s Twitter feed referenced North Korea using phrases such as “nkorea”, “north korean”, “rocket man”, and “kim jong”.

Read more: Why is North Korea launching missiles? Here’s what Kim Jong-un is trying to achieve

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataGoldman’s data revealed that on several occasions the Vix completely shrugged off missile tests but moved much more closely with Trump’s tweets on the subject.

The chart below suggests “a strong relationship between Trump’s tweets and the Vix”, according to the bank and could be taken to mean markets are more concerned that Trump will do — or tweet — something rash, than Kim Jong-un will follow through on missile threats.

Goldman said:

From a statistical perspective, testing does not appear to matter at all unless president Trump tweets about it.

Last week investors and analysts appeared unfazed by the latest North Korean missile tests with Japanese markets barely moving after an intercontinental ballistic missile landed in waters about 250 kilometers from its northwest coast.

Paul Kim, chief investment officer in Seoul for equities, told Bloomberg:

Investors had already expected that North Korea would continue to test fire a missile. Also, some market participants have already sold off shares on the risk recently. The important thing is the US response, but US equities didn’t seem to react to the launch and Washington didn’t respond to the issue much yet. In the previous launch, the US showed a strong response and that affected the US-China relations.

But this time, I don’t think the North Korean issues will affect the relations between US and China because they recently had a summit between Xi Jinping and Trump, reaching a consensus on North Korean affairs. I don’t expect any unexpected noise on the market.

In recent weeks, the Trump administration has sent mixed signals to North Korea — with the US president calling on North Korea to “come to the table” to make a deal to end its nuclear program in a recent trip to Asia while criticising secretary of state Rex Tillerson’s attempts to negotiate with the country.

I told Rex Tillerson, our wonderful Secretary of State, that he is wasting his time trying to negotiate with Little Rocket Man…

— Donald J. Trump (@realDonaldTrump) October 1, 2017