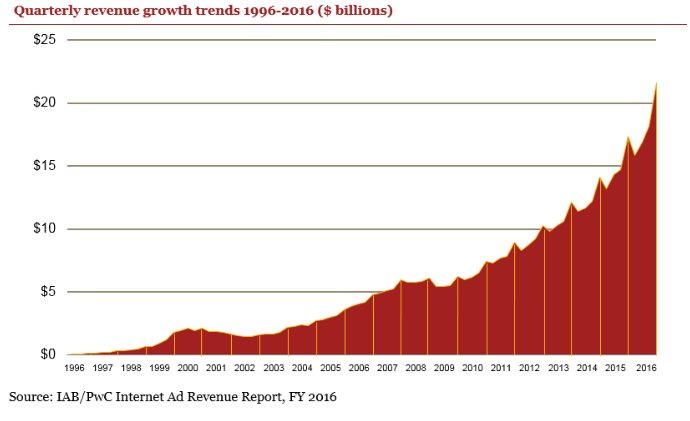

Advertisers spent $72.5bn on digital marketing in the US last year, an increase of 22 percent from 2015, according to a report by consultancy firm PwC for the Interactive Advertising Bureau (IAB).

Mobile advertising proved to be increasingly popular last year. For the first time, mobile advertising represented more than half of advertising spending.

“Mobile fueled the internet economy in 2016, with advertisers showing their confidence in digital to achieve their marketing goals,” said Randall Rothenberg, IAB’s president and CEO. “This increasing commitment is a reflection of brands’ ongoing marketing shift from ‘mobile-first’ to ‘mobile-only’ in order to keep pace with today’s on-the-go consumers.”

David Doty, the IAB’s executive vice president and chief marketing officer agrees.

“Brand dollars naturally follow consumers, and you’re starting to see a mobile-first, and sometimes a mobile-only mind-set among marketers,” he said.

Mobile “dominated” the more recent growth in the industry, he added.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataDigital audio was included in the report for the first time, generating $1.1bn in revenue last year.

Video advertising also saw strong growth last year, with spending jumping 53 percent to $9.1bn.

“Digital video’s powerful ability to attract engaged audiences is naturally attracting greater investments,” said Doty.

Otherwise, advertising continued to be dominated by tech giants Google and Facebook — accounting for the majority of industry growth according to Pivotal Research, an equity research firm.

Seventy-three percent of advertising revenue in 2016 during the fourth quarter went to 10 companies, but the IAB declined to name which ones.

Aside from Google and Facebook, it is likely that Yahoo, Twitter, Snapchat and Amazon feature in the top 10.

Advertising revenue has been increasing for the past decade at a steady rate, despite a slight dip during the 2008/9 recession.

Overall, retailers were the biggest advertisers in 2016, making up 21.3 percent of total ad spending.

Financial services at 13.3 percent the and automotive industry at 12.5 percent also advertised aggressively last year, followed by the telecoms, travel and consumer-packaged goods sectors.