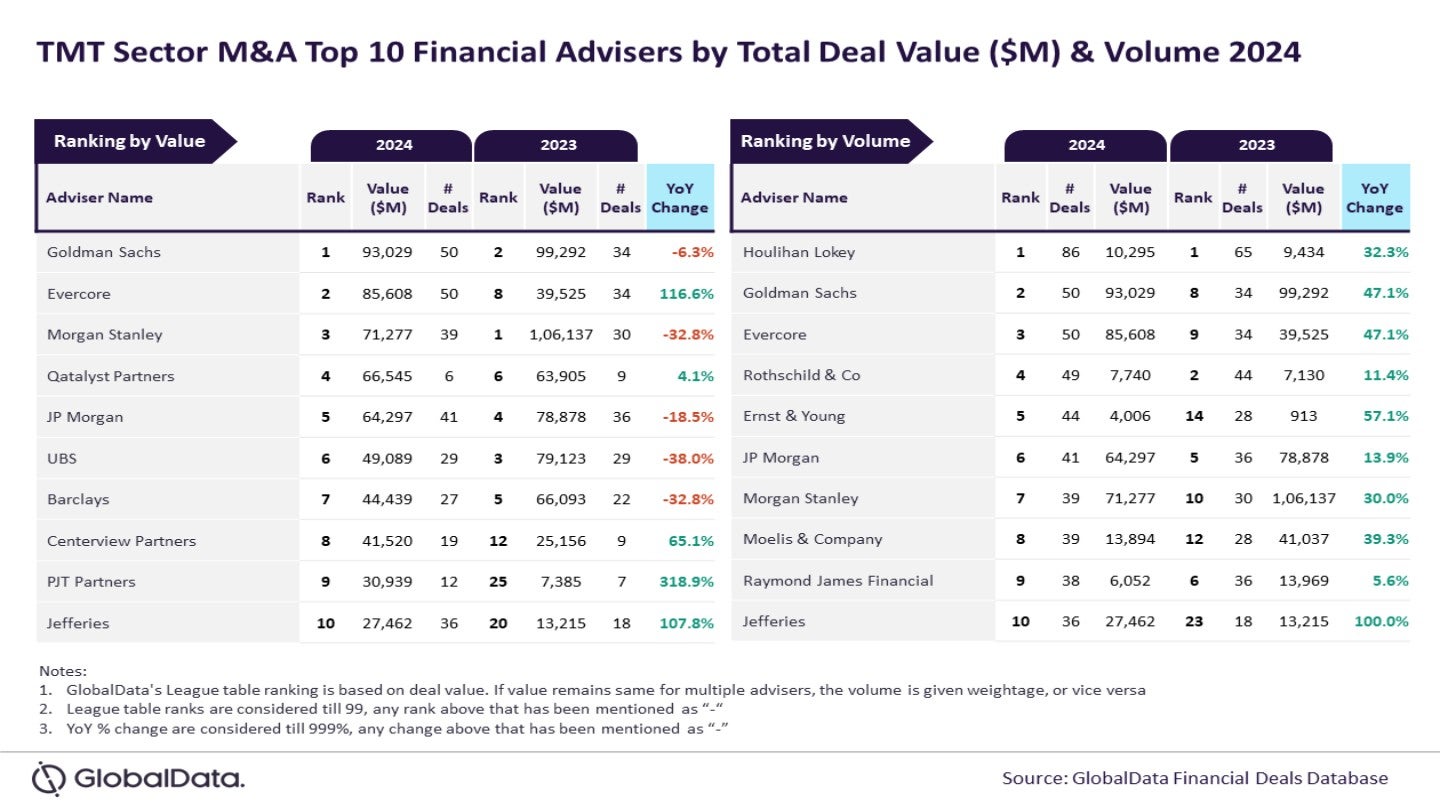

Goldman Sachs and Houlihan Lokey have emerged as the leading financial advisers in the technology, media, and telecom (TMT) sector for mergers and acquisitions (M&A) in 2024, according to the latest league table from GlobalData.

GlobalData is a data and analytics company that ranks financial advisers based on the value and number of M&A deals they have advised on.

The analysis, which draws on the company’s comprehensive deals database, highlights Goldman Sachs as the top adviser by deal value, while Houlihan Lokey led in deal volume.

As per GlobalData’s deals database, Goldman Sachs secured the top position by advising on deals worth $93bn.

Houlihan Lokey led in terms of the number of deals, advising 86 transactions during the period.

GlobalData lead analyst Aurojyoti Bose said: “All the top ten advisers by volume registered improvement in the total number of deals advised by them in 2024 compared to the previous year. Houlihan Lokey also registered double-digit growth in the number of deals and managed to retain its leadership position by deal volume from 2023 to 2024.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“Goldman Sachs, despite registering decline in the total value of deals advised in 2024 compared to 2023, managed to top the chart by value. In fact, its ranking by value improved from the second position in 2023 to the top position in 2024. Even though some of the other advisers among the top ten by value registered growth in total value of deals advised, there was still a notable gap when compared with Goldman Sachs’s numbers. Half of the deals advised by Goldman Sachs during 2024 were billion-dollar deals* that also included two mega deals valued more than $10bn.”

Evercore claimed the second spot in terms of deal value, providing counsel on transactions totalling $85.6bn.

It was followed by Morgan Stanley with $71.3bn, Qatalyst Partners with $66.5bn, and JP Morgan with $64.3bn in advised deal value.

In the volume category, Goldman Sachs took the second position with 50 deals. Evercore also advised on 50 deals. Rothschild & Co was close behind with 49 deals and Ernst & Young with 44 deals.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory company websites and other reliable sources available in the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness of the data, the company also seeks deal submissions from leading advisers.