Customers are increasingly turning to their smartphones to pay for products in the UK.

According to tech giant Apple, its Apple Pay system has seen a 300 percent increase since it launched in the UK just over two years ago and is supported by 23 banks.

Jennifer Bailey, the head of Apple’s payments business, said:

“Our momentum has been fantastic. We’re really excited about the progress.”

Apple Pay works as an app on iPhones and Apple Watch products. Customers can connect their bank accounts to the app and then make transactions using just their phone.

Worldwide, Apple has said it now has 1m users signed up to use the service on a weekly basis.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAs well, over half of contactless payment terminals, including retailers such as Waitrose, Sainsbury’s and Pizza Express, in the UK are able to take Apple Pay transactions of any value.

This gives Apple an edge over contactless transactions, which are still limited to £30 in order to prevent fraud.

The growth in mobile payments has led to Samsung launching its own Samsung Pay in the UK, in an attempt to catch up in the market dominated by Apple Pay and Google’s Android Pay.

The South Korean company could struggle to get its fan base to switch from using Google’s payments app, which has been available on any Android device for over a year, over to its own payment ecosystem.

Despite the success stories from the likes of Apple, the majority of consumers are still slow to take up this new technology to make transactions.

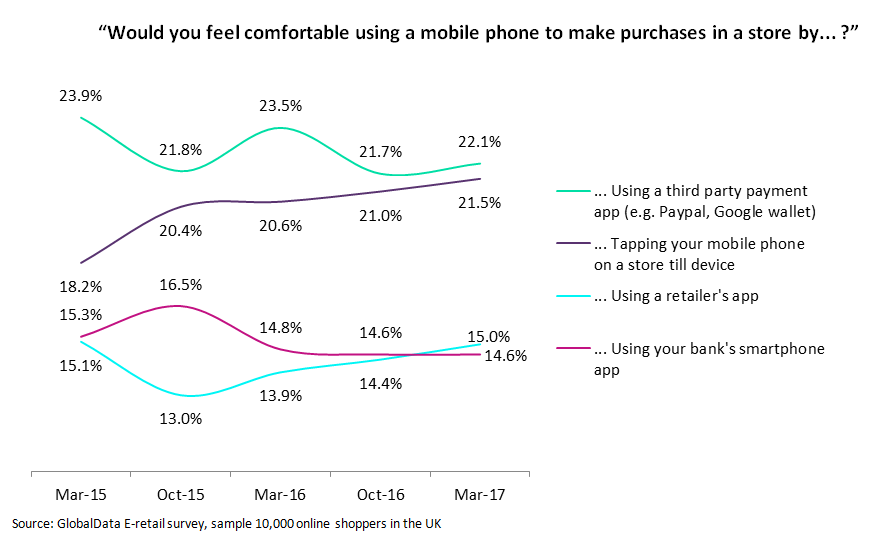

According to research by GlobalData, the percentage of people who say they would be uncomfortable to use their smartphones to pay for goods remains at around 58 percent.

Click to enlarge

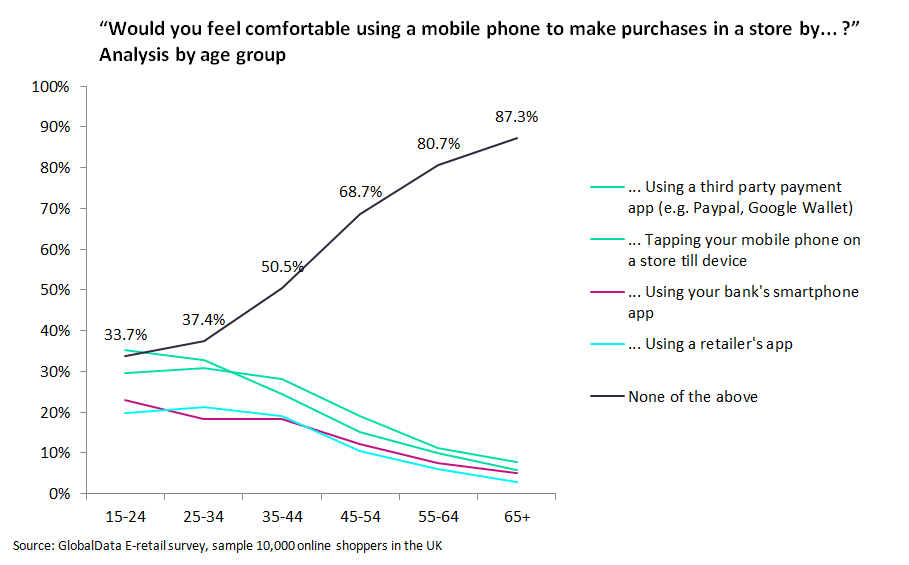

There appears to be a massive gap in between those over 35 and those under, with older generations choosing to shun digital payments.

Click to enlarge

However, older age groups may need to catch on to this new system fast.

A recent survey by ING found that one in three people in Europe would be happy going completely cashless, with around 54 percent saying the use physical cash much less than they used to 12 months ago.

As well, it is predicted that cities including London could become completely cashless over the next 20 years, meaning smartphone payment will become an integral part of the banking ecosystem.